Kwasi Dentsil-Koomson’s take on Ghana’s $4.8B lithium deposits

In 2018, Ghana’s discovery of lithium in commercial quantities was widely publicized to the excitement of many stakeholders. With further exploration ongoing, lithium deposits have been discovered in the Central, Western and Volta regions thus far.

Lithium is a rare earth mineral that has gained prominence in recent times owing to the critical role it plays in the growing electric vehicle (EV) revolution which relies on lithium-ion (Li-ion) batteries. Lithium is also widely used in the production of several electronic devices such as smartphones and computers.

Hence, Li-ion batteries will be more in demand as mobile electronic devices such as smartphones, tablets, laptops and other wearable devices proliferate with growing access to the Internet.

For a country with a long history of natural resource extraction dating back to pre-colonial times, (gold, bauxite, manganese, diamonds etc) the discovery of lithium came as a welcome surprise. Ghana’s proven 180,000 tonnes of lithium reserves rank the country fourth place on the African continent behind DR Congo (3,000,000 tons), Mali (840,000 tons) and Zimbabwe (690,000 tons).

Australia is currently the premier producer of lithium worldwide while Bolivia has the largest proven reserves of 21 million metric tonnes. It is projected that Ghana will generate about $4.8 billion over the life of the mine based on a five per cent carried interest in the project.

The carried interest of five per cent is similar to Government’s interest in other decades-old mineral mining agreement which have failed to yield notable benefits to the state or surrounding communities thus far. An exploration license for the project, which gives the mining company access to 139.23 square km of the lithium-rich site.

Deposits

The targeted first production of the concentrate is in the third quarter of 2024, subject to receipt of a mining license in the third quarter of 2023 and the project meeting all other statutory requirements. The project comprises deposits in Ewoyaa, Abonko and Kaampakrom approximately 100km south-west of Ghana’s capital Accra.

The project was initially estimated to hold 18.9 million tonnes of probable petalite and spodumene ore grading of 1.24 per cent lithium oxide (Li2O) containing 109 kilo tonnes of lithium (109,000 tonnes) metal as of March 2022. The mineral resource estimate for the project, however, suggests the lithium deposit in the area is up to 30.1million tonnes grading at 0.26 per cent lithium oxide.

Two million tons are expected to be mined annually, which implies that Ghana’s lithium deposit would be completely exhausted in about twelve years if more discoveries are not made. Countries around the world are adopting the G7 goal of cutting greenhouse gases by 40 per cent to 70 per cent by 2050 from 2010 levels and phasing out the use of fossil fuels by the end of the century.

To achieve this, a two-pronged approach consisting of progressive legislation on one hand and incentivization of electric automobile manufacturers via subsidies on the other hand has been implemented. Significant subsidies for electric vehicles have resulted in the success of EV manufacturers Tesla and more recently China’s B.

The exponential growth in the of adoption of viable electric substitutes for petrol-fueled cars such that tech giants Apple and Google are preparing to enter the fray with smart electric vehicles.

30 countries committed to stop the sale of new petroleum and diesel car models by 2040 at the COP26 conference in 2021. China, which is the largest vehicle consumer market, has launched an aggressive policy to reach a target of 75 per cent of all new car sales being electric by 2030. With sweeping policy changes such as these, the energy transition case which shows more than 60 per cent of global energy consumed being from renewable sources by 2050 is more likely to unfold.

Lithium-ion battery capacity could rise over five-fold

The demand for lithium could grow to more than 40 times current levels if the world is to meet its Paris Agreement goals. By 2040, Mackenzie estimates that the world will need 800,000 tons of lithium per annum for car battery production alone. The strategic importance of lithium can therefore reasonably be expected to grow in lockstep with prices due to demand outstripping supply as the global electric vehicle market explodes.

The lithium producing countries and lithium-ion battery manufacturers are set to earn billions from lithium mines and battery factories for the next two decades at least, all other things being equal. It is against this backdrop that Ghana’s strategic positioning as regards the exploitation of its lithium deposits deserves scrutiny.

The International Energy Agency’s Global EV Outlook published last year, sales of EVs doubled to 6.6m units in 2021 from the previous year. The total number of electric cars on the roads globally reached 16.5m, tripling from the quantity estimated in 2018. In the first quarter of 2022, 2 million EVs were sold, up 75 per cent year-over-year (YOY).

The worldwide lithium production in 2022 increased by 21 per cent to approximately 130,000 tons from 100,000 tons in 2021 in response to strong demand from the lithium-ion battery market and increased prices of lithium. Global consumption of lithium in 2022 was estimated to be 134,000 tons, a 41 per cent increase from 95,000 tons in 2021. The IEA estimated global lithium carbonate (LCE) output to increase slightly above demand to 650,000 tonnes for 2022 and 1.47 million tonnes for 2027.

Wood Mackenzie forecasts that global cumulative lithium-ion battery capacity could rise over five-fold from 2021 figures to 5,500 gigawatt-hour (GWh) by 2030 in response to massive EV expansion plans. Mackenzie also estimates that EVs will be responsible for over 80.0 per cent of global lithium demand by 2030 as they replace the estimated 1.45 billion petrol cars worldwide.

The price of lithium has grown exponentially since the introduction of lithium-ion electric vehicle batteries in 2017 rising from US$ 9,100 to US$ 19,000 per ton in January 2023. Other uses of lithium include pharmaceutical use, production of alloys, fuel, desiccant, glass, ceramics and automotive parts to name a few.

Ghana will generate about $4.8 billion

In 2012, the automotive sector accounted for 14 per cent of the Li-ion battery market. By the end of 2016, this had grown to as much as 25 per cent and presently exceeds 50 per cent. In terms of legislation, landmark policy decisions around the world include the EU’s recent complete ban on diesel and petrol cars by 2040 and the commitment of major automobile manufacturers such as Toyota to produce hybrid and fully electric vehicles only by 2030.

The rapid adoption of electric cars in developed economies has informed the policy shift in Western countries and China to gradually phase out fossil fuel-powered vehicles.

The time to strike is now as lithium supply security has become a top priority for technology companies in Asia, Europe and North America. Strategic alliances and joint ventures among technology companies and exploration companies are being established to ensure a reliable, diversified supply of lithium for battery suppliers and vehicle manufacturers.

In addition to significant ownership going forward, Government acting through the Trade ministry should approach major manufacturers of a wide range of downstream lithium compounds and lithium-ion batteries in particular to lobby for a plant to be sited in Ghana.

Ghana would be uniquely positioned

The lithium mined in Ewoyaa would be feedstock for the battery plant. This way, the more valuable Li-ion batteries would be exported instead of ore. Given the unreliability of critical inputs such as power and transportation infrastructure, Government may have to incentivize battery manufacturers with tax holidays, reserved power supply and perhaps concessions on standard local content requirements for a while to sweeten the deal.

The government could also emulate the effort to build refining facilities close to its lithium mines. This will ensure value addition and diversification of Ghana’s role in the global lithium supply chain.

The resulting long-term benefits would include GDP growth, employment, skill transfer and capacity building, development of related industries and most importantly evolution of the Ghanaian economy away from mere natural resource extraction.

Electric vehicle demand growth could be Ghana’s chance to launch phase 2 of the industrialization drive dubbed One District One Factory “1D1F”.

Ghana would be uniquely positioned to attract EV manufacturers such as Tesla and BYD looking to establish a regional presence as a result of a pre-existing ecosystem and its attendant economies. Significant value addition through the production of the technology and not just the natural resource would signify the maturation of our industrial sector and readiness for industrialization.

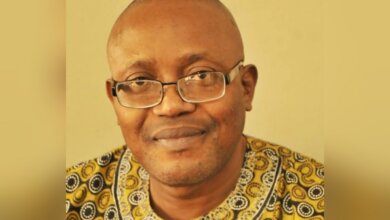

Written by Papa Kwasi Dentsil-Koomson, CEO of Mineserve Engineering Ghana Limited (MEGL) and Managing Member of Great Nevada Oil & Gas Exploration LLC, USA.

Disclaimer: The views and opinions expressed in articles and content by our contributors are those of their’s and do not necessarily reflect the official policy or position of our publication. We make every effort to ensure that the information provided is accurate and up-to-date, while holding contributing authors solely responsible for their contributions.