Europe may need Africa’s natural gas, shifting from Russia

Russia contributes 40% of Europe’s gas and produces 10% of the world’s oil. It is the world’s greatest exporter of cereals and fertilisers, as well as the top producer of palladium and nickel, the third-largest coal and steel exporter, and the fifth-largest exporter of wood.

With prices at record highs, the value of Russian natural gas exports to the European Union has risen to almost €500 million ($545 million) every day, according to the European research tank Bruegel. This represents an increase from around €200 million ($220 million) in February. Before the invasion, Russia was also selling hundreds of millions of dollars worth of oil to Europe every day.

Following Russia’s invasion of Ukraine, sanctions had been placed with the intention of freezing Russia’s economy for the long term, according the U.S Department of the Treasury.

These sanctions are taking its toll on Russia’s economy, but they haven’t yet affected fossil fuel exports, despite Western countries’ concerns about rising energy prices and living costs. At the end of the day, they want Russian gas to keep flowing, or better still, an alternate source.

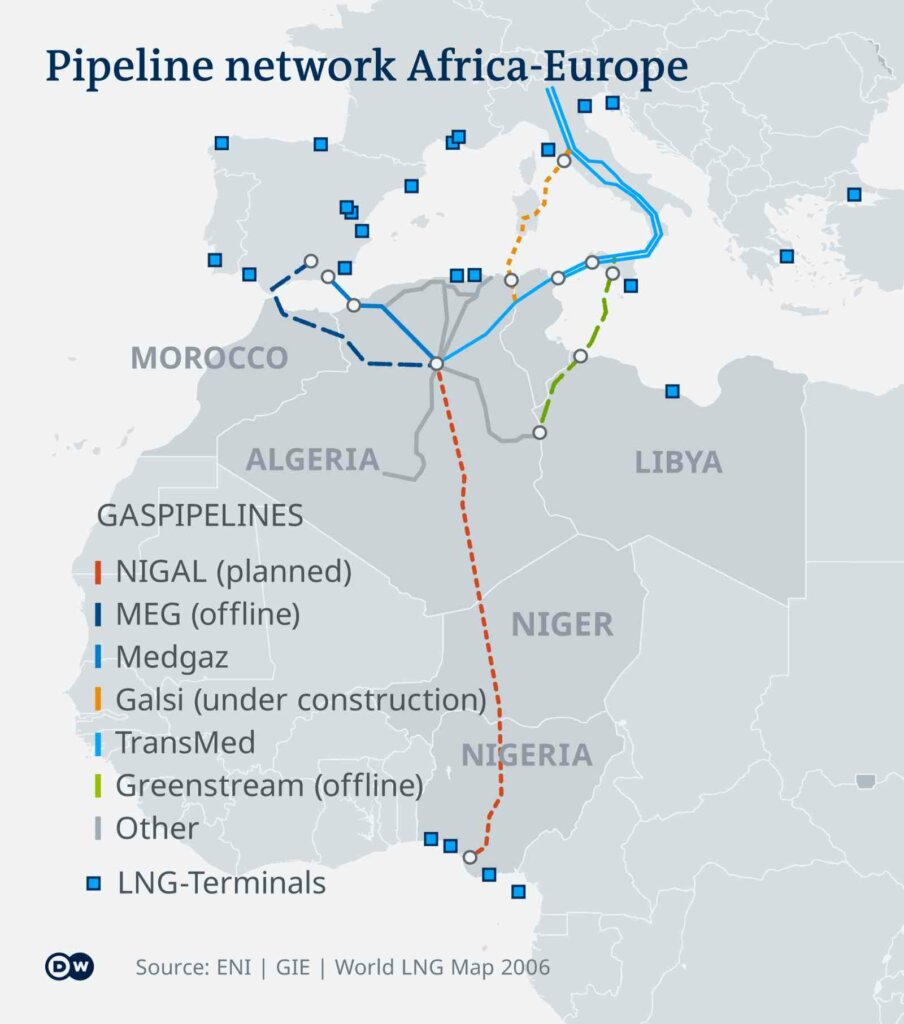

To reduce its reliance on Russian energy, Europe is increasingly importing natural gas from Africa. Despite the promise, there is a lack of supply and significant bottlenecks. Europe is being forced to diversify its energy supplies as a result of Russia’s invasion of Ukraine.

Read Also: Why Russia is Attacking Ukraine: Things you Need to Know

“Germany and Europe must now quickly make up for what they have missed over the last twenty years,” Stefan Liebing, chairperson of the German-African Business Association, said in a press release.

He strongly advised Germany’s Economy Minister, Robert Habeck, to travel to African countries including Algeria, Nigeria, Egypt, and Angola, which could assist Europe break its reliance on Russian gas.

NIGAL gas pipeline involving Nigeria, Niger & Algeria

According to Khadi Camara of the German-African Business Association, Europe purchased roughly 108 billion cubic meters of LNG in 2019, with more than 12 billion coming from Nigeria. Africa’s largest oil producer (Nigeria) is one of the top ten countries in the world with the highest gas reserves.

“They have more reserves than needed for their own market and are therefore predestined for export,” Camara said.

Other African producers, such as Algeria and Niger, which recently signed the Declaration of Niamey with Nigeria on 16 February 2022, at the Economic Communities of West African States (ECOWAS) Mining and Petroleum Forum (ECOMOF) – paving the way for the multibillion-dollar, 4,128-kilometer Trans-Saharan Gas Pipeline, which will run through the three countries and into Europe.

They now have the opportunity to attract funding for the project’s rollout and expand their production and experience.

According to media sources, the $21 billion pipeline will deliver up to 30 billion cubic meters of gas per year to Algeria then to Europe once it is completed, connecting the existing network to Europe which they would urgently require to meet demand.

African producers might use the outcome to attract the necessary investments for infrastructure development, allowing them to grow exploration, production, and exportation in order to meet the predicted increase in demand in Europe.

African countries have already begun to increase production. According to the African Energy Chamber’s Q1 2022 Outlook, Nigeria’s gas production will rise from over 1,550 billion cubic feet in 2016 to up to 1,780 billion cubic feet in 2022.

These production gains will allow Nigeria to expand internal capacity, assuring domestic and continental energy security while also allowing for increased exports to European markets.

Equatorial Guinea as well, with over 1.5 trillion cubic feet of natural gas reserves, which remains untapped, can also be an advantage of the anticipated European gas crisis to attract more investment for its natural gas market growth and development.

“The ongoing European energy trilemma and challenges provides a golden opportunity for African gas producers to develop a robust, bankable gas strategy to cater for motherland Africa and our European friends energy demand.

“I believe Africa can leverage current trends to attract much needed investment to develop the infrastructure needed to accelerate production for regional consumption and exportation. The time to act on the Trans Africa Gas plan is NOW.” said Abdur-Rasheed Tunde Omidiya, President of the Africa Energy Chamber (AEC) Nigeria and West Africa.

Read Also: How Africa is Affected by Russia’s Attack on Ukraine

The African solution is a long term fix

Member states of the Gas Exporting Countries Forum (GECF) convened in Doha, Qatar on February 22, 2022 to examine the implications of rising tensions between Russia and Ukraine on the global gas market.

Parties stressed in the Doha Declaration issued after the summit that, despite their pledge to increase gas production to meet growing global energy demand, they lack the capacity to help Europe replace 40% of its energy use if Russia stops supply.

“Infrastructure is going to be critical” said H.E. Gabriel Mbaga Obiang Lima, Equatorial Guinea’s Ministry of Mines & Hydrocarbons, in an exclusive interview with the African Energy Chamber (AEC) this month. “Investors in Europe may be selling solutions to be able to put as many terminals as possible, which will allow us to export gas to them. That is what we need in order to be competitive in gas,” he added.

Conclusions have been made that the African solution may not be a quick fix but will definitely be needed in Europe’s gradual shift from Russia over time – with the right infrastructures in place.

Source: DW | Africa Energy Chamber (AEC)

Abeeb Lekan Sodiq is a Managing Editor & Writer at theafricandream.net. He is as well a Graphics Designer and also known as Arakunrin Lekan.