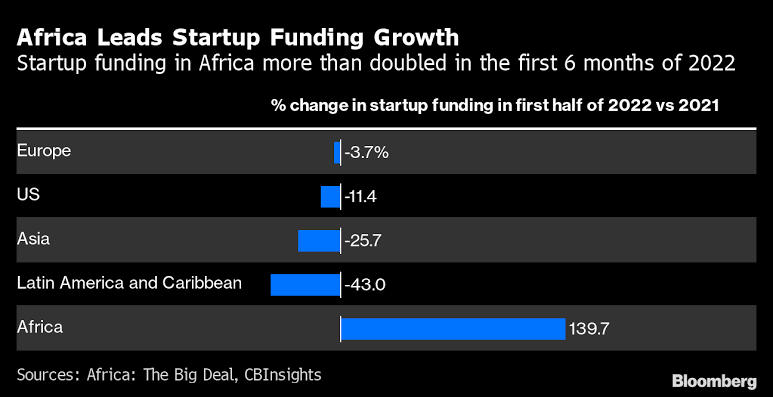

As funding for startups falls across the globe, Africa is standing out as a notable exception, with its under-served population outweighing the impact of inflation and slowing economies.

Funding for startups in the world’s second-largest continent more than doubled to $3.14 billion in the first six months of the year, according to research firm Africa: The Big Deal.

That compares with a decline ranging from 3.7% in Europe to 43% in Latin American and the Caribbean.

“Macro trends affecting developed-market tech names will be less impactful to Africa. Klarna, Paypal, others are being hit by fears over inflation and what that means for consumer transactions,” said Lexi Novitske, a general partner with Norrsken22, an Africa-focused tech fund that was set up by Swedish startup founders.

“Africa’s story is more around bringing the under-penetrated market online.”

If the trend continues, funding for startups may exceed the record $5 billion raised last year. Entrepreneurs are racing to provide services ranging from payment and health care to educational offerings to more than 1.2 billion people on the continent, which lacks adequate financial infrastructure and last-mile delivery.

Still, the amount received by African firms is minuscule when compared with countries such as the US, where companies raised $123 billion in the first six months of the year, 11% less than last year.

For some investors, that shows the opportunity in Africa.

READ ALSO: African Startups Raised $4 billion in 2021 in spite of COVID Restrictions

“The African venture capital market is far less advanced than that of the developed markets,” said Amrish Narrandes, head of private equity and venture capital at Cape Town-based Futuregrowth Asset Management.

“It follows that more growth can be expected in the African market.”

Africa’s advantages range from the undeveloped nature of its markets to a relatively young population who are quick to grasp the technology offered by startups.

The average age of an African is 18, compared with 31 in South America and Asia, the next youngest continents, according to Visual Capitalist.

“Startup companies in Africa are solving real problems, where existing businesses either do not exist or do not have the dynamism to make changes,” according to the African Private Equity and Venture Capital Association.

Traditional banks have failed to broaden access to financial services and decrepit state postal services provide opportunities for delivery companies, it said.

Still, even within Africa hubs are growing at different speeds. In the six months through June, the amount of startup capital raised increased more than fourfold in Kenya, while it more than doubled in Nigeria. New funding was little changed in South Africa, according to Narrandes.

The pace of the increase will also likely ease in coming months as the economic woes elsewhere have some impact as many of the funding rounds were agreed upon months earlier, Novitske said.

“I do hear from many founders things are slower,” said Ido Sum, partner at TLcom Capital, a pan-African fund. Even so, “fundamentals are still very attractive, probably more than many other regions,” he said.

Story by Antony Sguazzin, Samuel Gebre and Rene Vollgraaff for Bloomberg News

READ ALSO: Chipper Cash: How two Africans overcame bias to build a startup worth billions

Abeeb Lekan Sodiq is a Managing Editor & Writer at theafricandream.net. He is as well a Graphics Designer and also known as Arakunrin Lekan.