Africa remains one of world’s greatest opportunities for data centers & telecom – Lee Smith

There are a number of reasons why this is the case but, compared to the analysis from many, the level of investment seems to be more of a lackluster affair – for now.

I’m not going to bore you too much with piles of statistics in support of the opportunity but here are the CliffsNotes for the African opportunity:

- Africa consists of 54 countries with a collective population exceeding 1 billion.

- The 10 youngest nations on Earth are all on the African continent.

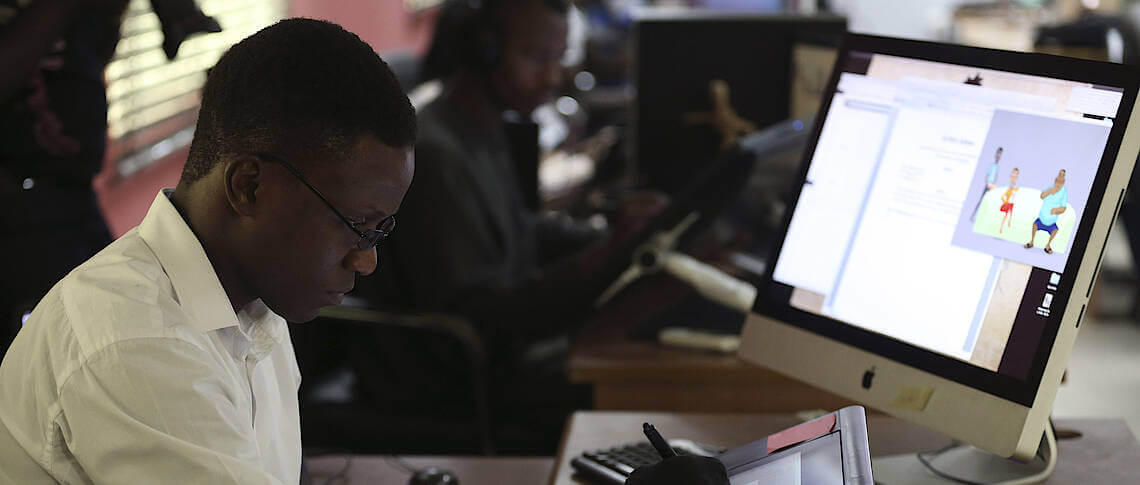

- A large part of this population are people under 30 years of age and they all want to go digital.

- As a consequence of its youthful population, Africa is predicted by the World Bank to see its overall economy (GDP) grow 11% – 15%.

- Businesses that migrate to the cloud are growing – a trend that continues.

- The African middle class is emerging.

The couple of points I raise don’t pertain to data centers or telecommunications at all. But consider the direct and indirect implications of these factors and how that will contribute to an increased requirement for data creation, data storage, data processing and the associated bandwidth requirements for the continent as a whole.

And where there’s data storage and data flow, you’ll find data centers. Combine this with a young, growing population and a larger African middle class – the growth continues exponentially.

According to the latest BroadGroup report – Data Centers Africa II – published in August 2018, the top four data center markets in Africa, measured by capacity and power availability, are South Africa, Kenya, Egypt and Nigeria. Cloud expansion, mobile data and increased international and domestic bandwidth are mentioned as driving the growth of data centers across Africa.

As late as December 2018, an Econet subsidiary, Liquid Telecom, announced its investment of 8 billion Egyptian Pounds (USD $400M) in Egypt over the next three years. This is part of their partnership with Telecom Egypt and includes data centers and telecommunications infrastructure. An initial investment of USD $50M will be in data centers and the remainder will be in broadband and financial inclusion activities, as well as high capacity data centers. This investment forms part of its Cape-to-Cairo network strategy.

Kenya is regarded as Africa’s eastern hub for telecommunications and data centers. The establishment of footprints in Nairobi, such as East Africa Data Center and Safaricom as well as icolo.io in Mombasa, are all testament to the demand for data centers and telecommunications infrastructure in this part of Africa.

Nigeria has seen the likes of MainOne’s MDXi data centre and Rack Centre being established in the past five years – both residing in Lagos. Before 2013 there were no such data centers in Nigeria. Rack Centre, under the stewardship of Ayotunde Coker, opened its site in 2013 and their growth has been steady ever since. Under the stewardship of MainOne’s Funke Opeke, their MDX-1 data center was commissioned in 2015 and has shown the same trend.

MainOne also announced its plans to partner with Legrand subsidiary Minkels to expand the telecommunications company’s data center business into other parts of Nigeria, Accra in Ghana and Abidjan in Côte d’Ivoire.

When it comes to data centers and telecommunications, South Africa is still regarded as the largest market in Africa. Microsoft has established a number of cloud footprints in Cape Town and Johannesburg. Amazon Web Services (AWS) also opened an infrastructure region, AWS Africa, in Cape Town after announcing it during the first half of 2020. With the two largest cloud service providers setting up shop in South Africa, the game is on – both here and in the rest of Africa.

Obviously the plans of both these organisations usually are not static and more growth is anticipated. Other cloud providers are likely to follow suit, or they risk losing out.

All of this is driving the demand for hyperscale data centers in South Africa. The likes of South Africa Data Centre, another subsidiary of Liquid Telecom and Internet Solutions, a subsidiary of NTT’s Dimension Data, have announced deals that are driving their expansion projects. Probably the most notable success story in South Africa would be Teraco Data Environments.

Starting from very little in 2008, Teraco has grown to become the largest colocation data centre company in Africa with data center power capacity exceeding 60MW. For others around the world this may seem small but consider that Teraco started just over 10 years ago with less than 1MW. It’s publicly announced expansion plans exceed USD $75M. According to Chief Financial Officer Jan Hnizdo, spending exceeded USD $300M when this investment cycle ended in 2019. All of this points to a positive data center picture.

Morocco is the new kid on the block, having joined the other top four not so long ago. Marrakech was also witness to the founding of the African Data Center Association (ADCA), currently composed of over 30 Africa data center operators and stakeholders. Again, its positioning in West Africa and its expansion plans, specifically related to renewable power infrastructure, positions it as a future data center investment opportunity to consider.

There are so many other opportunities that are available across the entire African continent. Ghana, Angola, Rwanda, Uganda, Mauritius and Ethiopia are but a few. All of these have huge potential because Africa’s people and businesses want to connect to each other and to the rest of the world.

These are just some examples of the growth in this sector on the African continent. Also consider that there would be no growth in data centers, cloud, hyperscale or anything digital without the other equally important requirement – connectivity. Subsea cables are currently running along African coastlines, landing on the shores of many countries and then running further into the land-locked parts of the continent.

This infrastructure connects Africa’s people to the rest of the world. The continued increase in subsea cables working onto the continent is evidence of the expected growth and expansion.

Yes, Africa has its problems. And yes, the obstacles might sometimes seem insurmountable. But the obstacles can be viewed as stepping stones to growth in the data center and telecommunications markets. Also remember that Africa is not a country – it’s a continent with 54 countries. What impacts one country or region does not necessarily have an impact of the rest of the continent.

Africa is set for significant adoption in cloud services. There is a shift in the requirements when it comes to data centers and network infrastructure. It’s being driven by the people and business. In terms of market penetration it still remains untapped. The demand for communications infrastructure from a growing population and from a business perspective, the increased demand in cloud services, disaster recovery, resilience and more points to one undeniable conclusion: Opportunity.

So I’ll finish off where I started with this article – Africa still remains one of the world’s greatest opportunities for data centers and telecommunications.

About the author

Lee has been operating IT infrastructure for more than 25 years. He has a wide range of experience, ranging from IT Operations and Engineering through IT Infrastructure Management. Lee is an industry executive and founder of DataCenterDNA, a boutique consulting firm based in Northern Virginia, that provides specialist data center industry consulting and advisory services.

Although living in the USA, Lee continues to be a very active participant in the African digital infrastructure industry.

Source: InterGlobix

Abeeb Lekan Sodiq is a Managing Editor & Writer at theafricandream.net. He is as well a Graphics Designer and also known as Arakunrin Lekan.