Ghana has become the first African country to implement a universal quick response code (QR Code) payment system. The innovative technology was outdoored in Accra on Thursday when Vice President Bawumia demonstrated its practical implementation at the popular Aunti Muni Waakye in Accra.

The universal QR Code payment system allows a customer to make payment for goods and services to a merchant from a mobile wallet or a bank account directly from a mobile phone, and the Vice President used his QR code to pay for the waakye in a simple process, which lasted less than a minute.

The successful outdooring of the QR code makes Ghana the first African country to implement this remarkable digital technology.

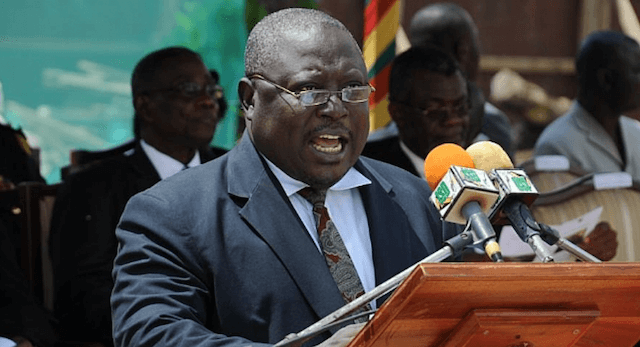

Speaking to the media after the practical demonstration, Dr. Bawumia described the digital payment innovation as historic and a game changer in the government’s quest to digitise the economy and also transform Ghana into a cashless society.

“Today is a historic day because we are solving a major problem here in Ghana. It is also historic because Ghana will be the first country in Africa to launch a Quick Response (QR) code payment system,” Dr. Bawumia said.

“Not only are we the first country in Africa, we are also, as far as I am aware, the third country in the world to launch a Quick Response Code after Singapore and India. However, Singapore and India, their QR codes only cater for bank customers. Ghana’s QR code will cater for both bank and non bank customers, that is those who use mobile money and have bank accounts. So in this regard, Ghana’s QR Code is unique and it is the first of its kind in the world.“

“So we have to be rightfully proud as Ghanaians that we are using technology to solve a problem that exist in our country and in doing so, we are really leading the world.”

Highlighting the significance of the universal QR code, Vice President Bawumia noted that its implementation, alongside the mobile money interoperability, will include those who have historically been excluded from the financial system.

“Once again, we are moving to solve a major problem in our society, making it easier to access and pay for goods and services.”

“Ours is a cash-based economy, which is very inefficient. Historically, many have been excluded from the financial system, but we have since been working to make Ghana’s economy a cash-lite, more efficient one, with the introduction of the Mobile Money Interoperability and today, Universal QR Code.“

“A cash-lite economy has so many advantages. It promotes transparency, prevents robberies, helps the growth of e-commerce and fintech, and in this day of Covid 19, cash, which is a known spreader of the disease can be avoided by using the QR Code.”

Dr. Bawumia disclosed that 13 banks have so far rolled out the QR Code, while telcos, Vodafone and Airtel-Tigo have also joined, with MTN on the verge of doing so.

He lauded the collaborative efforts of the Ministry of Communications, Bank of Ghana, Ghana Interbank Payment and Settlement Systems (GhIPSS), telcos and fintechs for coming together to achieve another digital landmark by the government.

When you go to the merchant with a universal QR Code, as long as you have a bank account from any financial institution or a mobile money account from a telco, you’ll be able to pay the merchant regardless of which bank or telco has acquired the merchant or service provider instantly.”

How the QR CODE works

After he used he paid for his waakye through the universal QR code, Vice President Bawumia provided a detailed explanation on how it works.

“The universal QR code will bring about interoperability across the telcos and across all the banks and between the banks and the telcos. They will all be on the same platform and this is the game changer,” Dr. Bawumia said.

“When you go to the merchant with a universal QR Code, as long as you have a bank account from any financial institution or a mobile money account from a telco, you’ll be able to pay the merchant regardless of which bank or telco has acquired the merchant or service provider instantly.”

“Any merchant can have it so whether you are a chop bar operator, barber, carpenter, musician, mason, shoe shine boy, khebab seller, kofi brokeman seller, market trader, trotro, taxi driver, churches, schools, mosques and even funeral committees for donations, you can get the QR Code. Basically, any business can get a QR Code,” Dr. Bawumia explained.

“What is very interesting is that any owner of a phone, whether it is a smart phone or a yam phone (feature phone) can use the universal QR code. So it is not limiting people to just smart phones because we have a large number of people who use feature phones or yam phones.“

The universal QR code is the latest digitization success by the government after the successful implementation of mobile money interoperability, as well as the digitization of many government services such as paperless system at the ports and online services for drivers licence, passports, business registration, among many others.

Source: graphic.com.gh

Christopher Sam is a savvy web designer and developer with advanced knowledge in Search Engine Optimization. The certified Google Trainer is also a trusty contributor to this website.